To: Inheritance Tax

HMRC Revenue and Customs

BX9 1HT

To Head inspector, This also to Fraud report. Also sent to several MP who are involved in the committee on Dementia Fraud

Your Ref

Subject: URGENT: Mavis Banks Date of Birth 22 June 1929.

Died on 14 March 2015.

Home & business address of 32 Hoole Road Hoole, Chester CH2 3NJ

From: Dr Mark Jones FRSM MBA, PhD, Ma, PgDip :.

Freeman of the City of London. Fellow of the Royal Society of Medicine.

Tel (44)

All correspondences by email please: As I have moved address.

All of the files will be stored on http://corruptsolicitors.co.uk/z-file/

Password:

Dear HMRC,

I am the son of Mavis Banks Date of Birth 22 June 1929. Died on 14 March 2015.

Home & business address of 32 Hoole Road Hoole, Chester CH2 3NJ.

I am the only acting relative and next of kin. My mother’s NI number is

I send proof of this by the following attachments

1 Exhibit Caveat 1 DEC 2016.pdf

2 biz as b and b.pdf

3 letter from Nationwide Bank with Cheque for 3522.00 from my mother

There are five issues with my mother’s estate.

1 Business Property Rates for my mother’s home which was also a Bed & Breakfast.

2 Fraud by Bartlett (see links) and looks like a cover up by James Beresford which effects Tax as he is not reporting this after being told several times

3 I reported this to the Tax in the past but on 12/03/2020 this had vanished off the system & this must be investigated as my mother was one of many, and there is a network of criminals doing these crimes.

4 It can be shown by the Dec 2019 probate court case that a police detective (MA, files on web site) gains from these crimes. Therefore no investigations were done due to his support of these crimes.

5 Subject Access Request of all files including backed up of my mother & me.

Issue 1 Business Property Rates for my mother’s home which was also a Bed & Breakfast

I have already started working with a trusted accountant.

I am asking for him to do the accounts. I am willing to go to court to get this done right.

He has made it clear he thinks we have everything we need for the Business Property Rates, therefore no tax for my mother’s business. He also has backed up what now several lawyers have also said that this is true.

In fact, the accountant says

I am happy to prepare the accounts for you, but essentially I would not want to put you through the added expenditure if the solicitor is satisfied that with the evidence you provide

I point out that my mother’s property was a business “Bed and Breakfast” therefore entitled to Business Property Rates (BPR), therefore no tax and this is backed up by the following:

Point 1

B & B insurance

see attachment

biz as b and b.pdf

Point 2

Also the email below from Council Tax on 17 Feb 2020 saying my mother home is Bed & Breakfast and was Non Domestic Rate as it was a business for years

Start of Email

———- Forwarded message ———

From: Council Tax (West)

Date: Mon, Feb 17, 2020 at 11:42 AM

Subject: – Hoole Road

To:

Dear Dr Jones

The account has been reviewed, and it has been determined, as previously advised that that the property remains a HMO for Council Tax purposes and does not fall under the Non Domestic Rates category. Please continue to pay as requested. Further to your request for your mothers National Insurance Number, we do not hold this information, you would need to contact the Department for Work and Pensions or HMRC.

Yours sincerely

Billing & Debt Team

Cheshire West & Chester Council

Tel

Email

End of Email

————End message————-

Point 3

See accounts done by my mother’s accountant BD who died, see attachment,

GuestHouse2007to2010.pdf

Note is shows bills for food for Breakfast for the guest etc. I also have bills that show guests had breakfasts etc so making the B&B but one lawyer said not an issue with all this evidence.

It was also a guest house after her death.

Point 4

I called the tax man several times and they have said… no tax to pay on my mother’s estate.

Issue 2 Fraud

The following is based on P. Bartlett (my mother’s ex lawyer) own submissions to the Probate court and are also on the following web site:

The IHT 400 Bartlett sent to the Tax man in 2015, 2016? see page 5

Image above from attachment: 3522BANKS M iht400-integrated 040614 V2 .pdf (3,216K)

Page 5 of IHT 400 shows Question 40 ticked as NO so no IHT413, which is a deliberate lie

Then Question 38 & 39 say no shares but this is too a lie and as P. Bartlett was the executor he should of done a search but did not, my own sister lied in court that my mother had no money so they were working together. As share letters arrived at my mother address in 2020 so a lie.

It was only after my sister death in 2019 these started to appear? The new Executor James Beresford says he can do a search for this so why could not Bartlett when he was the executor of my mother’s estate, other than he knew they existed and was going to steal them with my sister.

My sister had to say in court she had forgotten 40,000 of my mother’s money when I confronted her with a bank book of this amount. And when my mother died 60,000 plus appeared.

Also in medical records my mother is saying my sister and MA are stealing from her

The IHT400 page 5 also did not list my debt in number 46 IHT 419 which Bartlett knew was greater than the estate.

Then Bartlett added a debt of 100,000 (see page 8 of IHT400) to my mother which was also a lie he knew from 2015 was 10,000 but kept this hidden until Dec 2019 when he tried to settle out of court but wanted me not to talk about the Tax fraud and all his other deliberate actions he did to steal my mother’s home and business. And he has done this to many others including next store.

Then Bartlett (who owns the law firm Mathew Lewis) on the 15 Feb 2016 took money from my mother’s account to pay to the tax man 3522.00 based on his lie. All based on the IHT400 attachment: 3522BANKS M iht400-integrated 040614 V2 .pdf (3,216K) which he knew was a lie but he still used and paid a false amount from my mother’s bank.

Then Bartlett kept the lie going even in 2019 Dec probate court case and then the new executor of my mother’s will James Beresford of blmlaw.com continue the cover up. By law he should report this.

Letter 15 Feb 2016 to Mathew Lewis which Bartlett owns and runs from my mother’s bank.

The Bank have said Fraud is going on.

The following shows 100,000 debt lie from Bartlett’s own court papers

1 The main issues in two pages are the following:

All exhibits listed on the following web site:

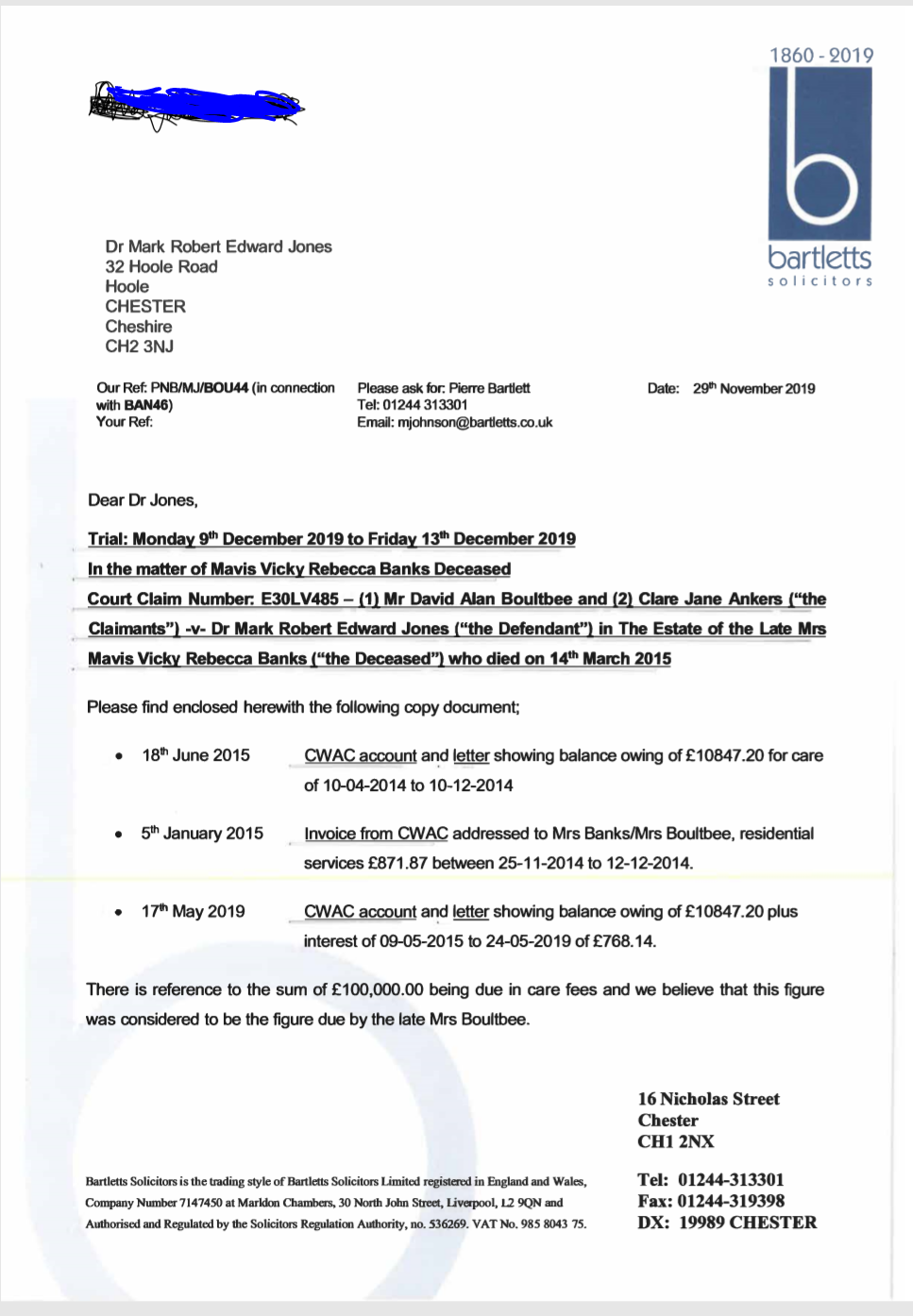

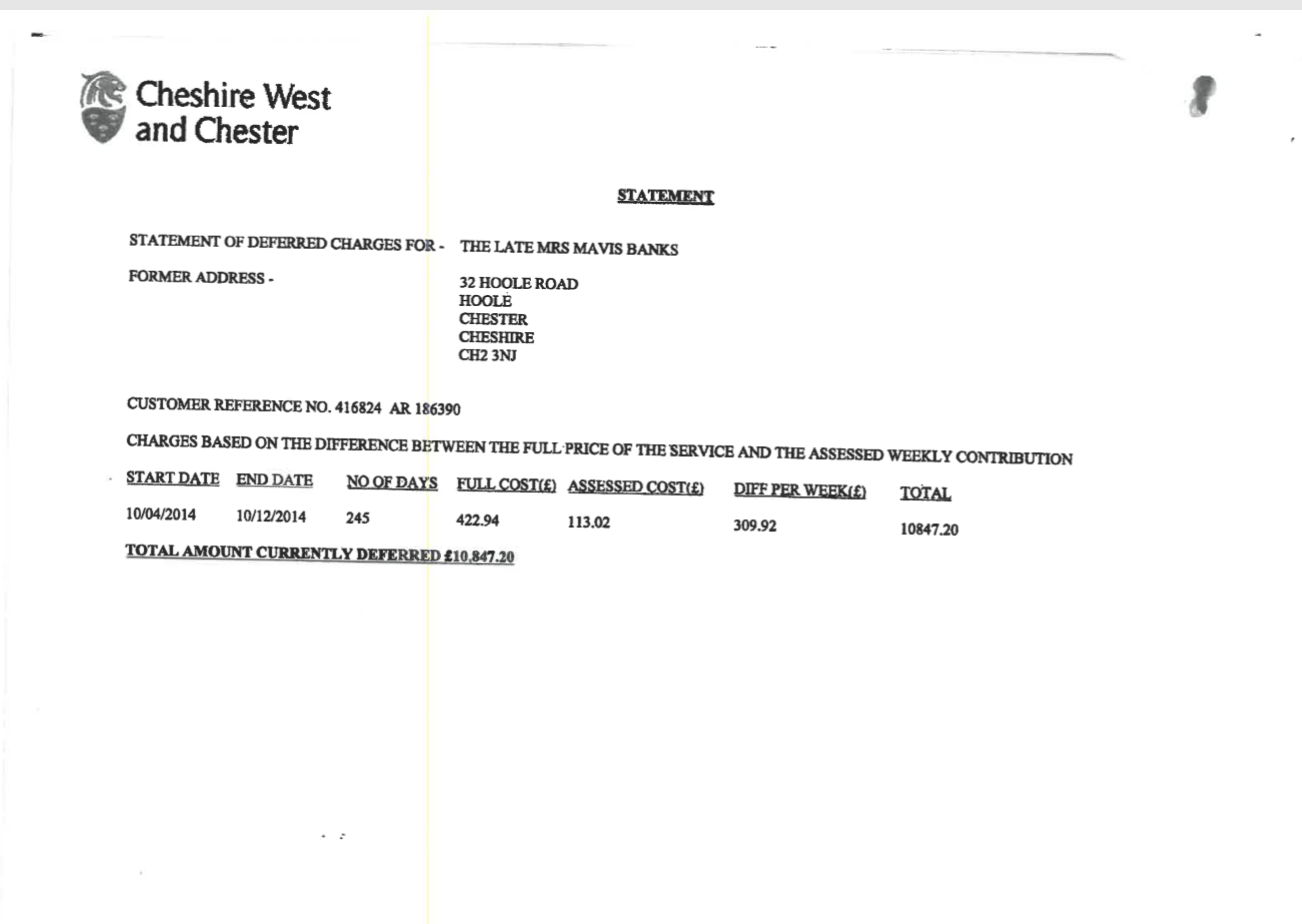

1.1 Bartlett went to Court in 2018 with a care bill for my mother of 100,000 (Exhibit below)

1.2 which Bartlett & Mr Green his lawyer knew from 2015 was only 10,000 (Exhibit below)

1.3 Therefore Bartlett and his lawyer Mr Green lied to the Court and did fraud. NO DOUBT.

NO OTHER POSSIBLE REASON.

The following letters from Bartlett from 2015 onwards used in the court case.

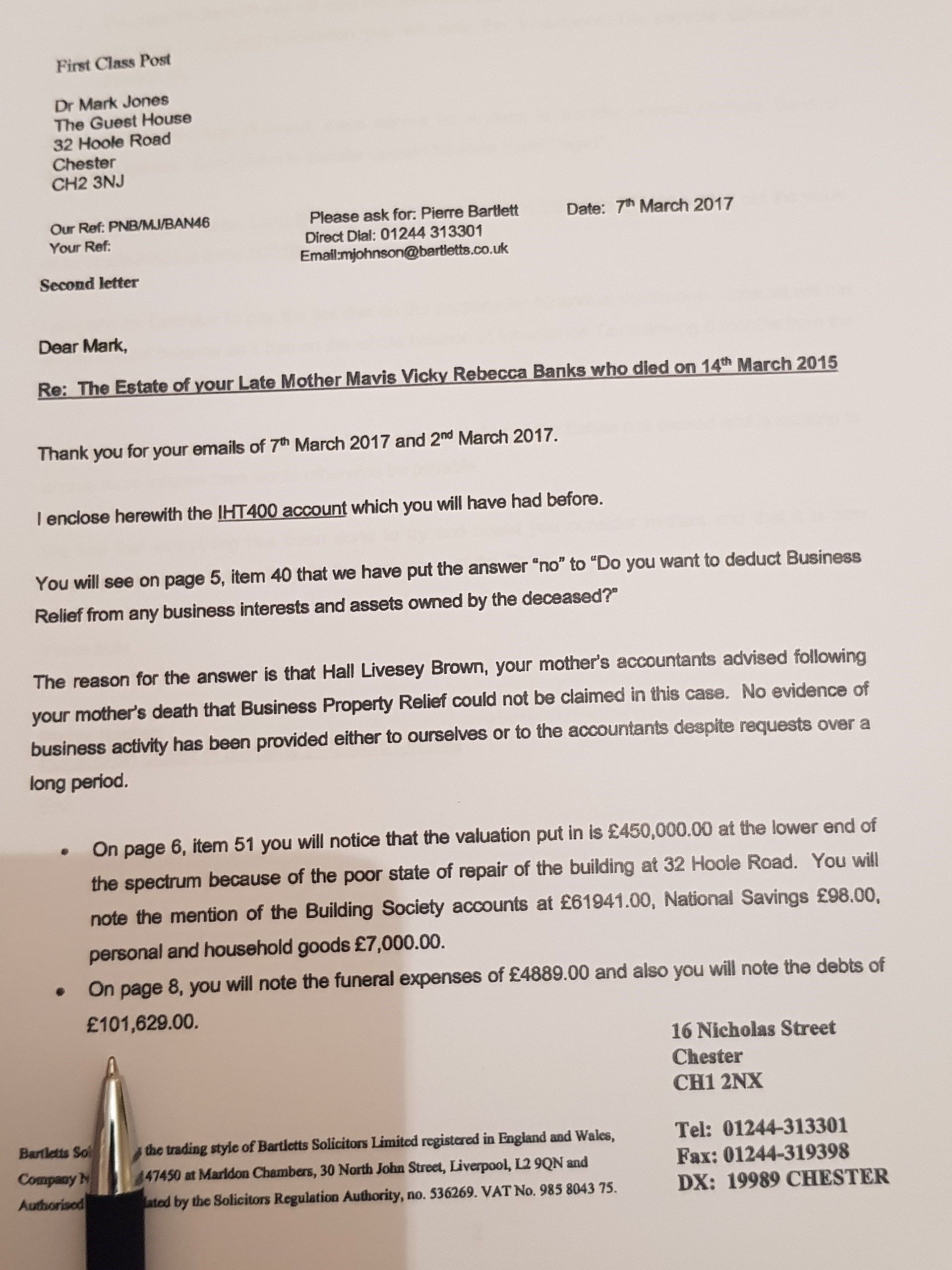

Letter From Bartlett showing the amount of money in debt by the pen point. Letter below 7 March 2017

The letter Bartlett sent about the Inheritance Tax to me in 2016. See Official Tax Document below. Sent to Tax man as true!!! The pen points to the lie of 100,000 debt

Page 8 of the IHT 400 that shows Bartlett add 100,000 debt to my mother which is not true.

Image above from attachment: 3522BANKS M iht400-integrated 040614 V2 .pdf (3,216K) sent from Bartlett to the Tax and then also paid as true value. The pen points to the lie of 100,000 debt

The letter Bartlett was forced to send to the court in 2019 Dec. Note Bartlett blames my dead sister for the bill being wrong but he was the executor of the will by force. He knew this 100,000 from 2015 onwards was a lie. In Nov 2019 he said it was reduced by me but the paper works shows he knew it was 10,000 in 2015 onwards. MA would have also known this was a lie.

The 2nd part of the letter where Bartlett says a friend of the family found a buyer for my mother’s business but in court MA & his court papers said this was him. See below letter. Note Bartlett also lies saying “you will note what appears to be your writing script that states ‘I am not selling up’

this is another lie by Bartlett and this was seen to be so in the court.

The Stamp on the letter from the company Bartlett owned state bill received on 22 July 2015 for 10,000 and clearly never was 100,000

Letter above showing true bill in 2010 which Bartlett and MA knew about. Note Court medical experts said mother was very ill so should not have to pay the 10,000. Letter Sent to Bartlett in 2015

1.4 The Court was unaware of these above actions; therefore, Bartlett & Green went to Court with dirty hands. They lied about this and other things.

1.5 Ex turpi causa non oritur actio.

2 We ask for all Court action to be removed in any court case Mr Bartlett & Green is involved with Me as he used the above lie in all parts of the court case I had with him.

2.1 We seek damages from 2007 on wards when Bartlett first started these actions with his lawyer Mr Woodside help

2.3 They preyed on my mother who had medical issues for gain.

2.4 They failed their duty of care to my mother and me.

2.5 The lawyers said Bartlett and Woodside did the Wills wrong on purpose to cause problems and cause costs.

Issue 3

I reported this to the Tax in the past but on 12/03/2020 this had vanished off the system & must be investigated as my mother was one of many, and there is a network of criminals doing these crimes.

Why was this removed and by who?

Issue 4

It can be shown by the Dec 2019 probate court case a police detective MA gains from these crimes so no investigations. In fact the police SAR (Subject Access Request) proves there was no investigation on the several attempts on my mother’s life. So an investigation by police not from North West is required see http://corruptsolicitors.co.uk/a-bent-police-detective-who-should-investigates-but-does-not-puts-firewall-and-witnesses-shut-up-and-he-asks-for-180k/

And after the court case in Dec 2019 there is new evidence to show my mother was murdered but the coroner who knew MA & Bartlett has lost the inquest tape

http://corruptsolicitors.co.uk/2020/03/03/inquest-tape-thats-shows-elderly-abuse-murdered-by-bent-lawyers-and-police-for-gain-the-perfect-dr-shipman-team/

Issue 5

I ask for a Subject Access Request (SAR) of all files including backed up of my mother & me.

I hope to hear from you soon as this is urgent.

Thank you

Notes

Mr. Bartlett is already reported in the March the 6th in 2006 by the Law Society File No 8751-2003 see attachment Bartlett-8751.03.pdf (1,512K).

Download here Bartlett-8751.03

The SRA did everything to protect Bartlett and Woodside, who the court expert said was telling the truth that my mother said Woodside hit her to change her will, tell her she had no money to force her to sell her home to Bartlett.

http://corruptsolicitors.co.uk/dementia-fraud-murder-bent-lawyers-bent-cops-bent-sra/

See also http://corruptsolicitors.co.uk/corrupt-solicitors-chester/bartletts-solicitors-chester/

Note Bartlett says he is not involved pre 2008 but

Update

P said “But I probably can’t unless I can get hold of all the paperwork, which they’ll probably postpone as long as they can and tell me its in the cellar archives.

I think, but I’m not absolutely sure, but Bartlett worked with my corrupt brother to sell my Father’s house to XX Hotel, Chester owner and make a profit between them on it. I found out off XXX he paid one price and was told by Bartlett it sold for another price – less than what XXX paid for it. So in actual fact when I checked the bank statement the lower price was shown and not the higher price for which it was sold.

The house even went to auction three times but was withdrawn as I was there and wanted to make a bid on it”

Update 19/04/2020

http://www.legislation.gov.uk/ukpga/2006/35/introduction